Investment Update: FY2022 - The year that was

The articles are a little misleading though. Firstly, because superannuation is a place to have money invested and not actually an investment itself and secondly because they tend to focus mostly on a balanced investment approach and use this as a “weathervane” of performance.

Generally, this is a mix of Australian and international shares and property, fixed income, bonds, cash and whole groups of diversified investments.

The other point to consider is that the term “balanced” can be very different between superannuation funds, with some funds having 40% exposure to growth assets, while others have 80% exposure to growth assets.

Growth assets are generally shares and property. So as you can imagine, this difference can have a very large impact on the return each year (both up and down).

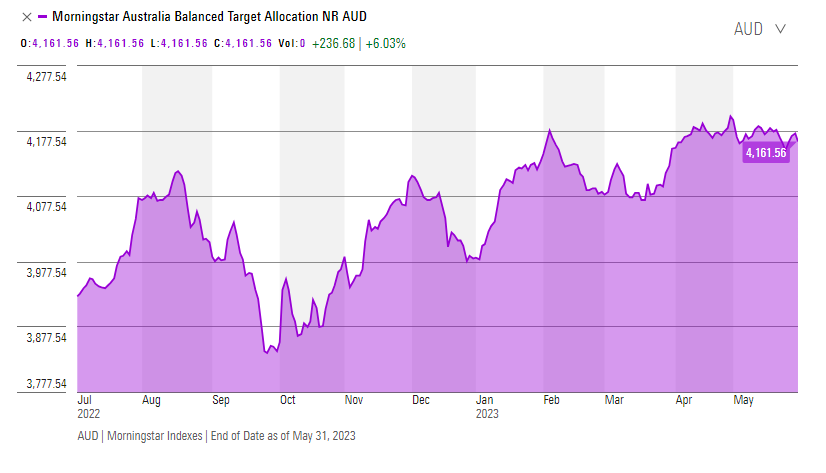

Super Fund Performance (results to 31 May 2023)

.png)

Source: Chant West - Performance is shown net of investment fees and tax, before admin fees and adviser fees.

When we look at these returns, like every year, it’s not a straight line (as much as we would like it to be), but a ride up and down with short term volatility:

So what contributed to these changes?

Interest rates

Much like the first half of last year, interest rates were aggressively raised between July and October 2022. Increasing interest rates is the tool Reserve Banks use to try to get inflation into control by reducing how much disposable income people have, which in turn should reduce demand for goods and services and prices.

But the result of this is that it puts the brakes on an economy and if those brakes are pushed too hard, it can lead to a recession.

Those recession fears first emerged in August 2022, which led to a pull back in markets. But as Reserve Banks around the world started to provide more information on their forecasts for interest rates and inflation, the market moved positively from October 2022.

Inflation

As China opened up from their Covid lockdowns last year, shipping lanes started to come back online, world production increased and the supply of goods began to flood back into the country again.

While this led to a reduction in inflation for goods, prices for services have remained high due to low unemployment and because individuals are still spending money which they saved during Covid.

But inflation is starting to slow and a path where inflation returns to the normal range is starting to appear.

Company Profits

As a result of low unemployment and the high level of savings held by individuals since Covid, company profits have been healthy which has supported returns.

In Australia, this has been furthered by high commodity prices (think energy, agriculture etc) and a lower Australian dollar which increased demand for Australian exports overseas.

The focus of the last financial year has been on recovering from low supply and on high inflation. This made for a very tough investment environment, similar to FY2021.

While things are looking more positive, there are still a number of issues to watch that could have a big impact on the next 12 months.

Interest Rates

As a fall out from high inflation and low unemployment, Reserve Banks around the world have been very aggressive in their words and actions around interest rates. While this has seen inflation drop from its heights, most Reserve Banks have stated that they expect to continue with their current approach for some time.

For a debt free person who has money in the bank, this is a great result as interest rates are at their highest in 15 years. But it has really hurt those with debt and the full effect of interest rate changes may take 12-18 months to completely show in the economy.

As of Tuesday, the Reserve Bank decided to keep rates on hold (for this month) at 4.1%, but the consensus from economists is that we are likely to see another two rate rises before the end of the calendar year (total 0.5%).

A good portion of Australian homeowners are also now seeing their ultra-low, fixed interest rate period ending and reverting back to standard variable rates, resulting in monthly repayments tripling in some cases.

Recession

To use a car analogy, it’s not easy to put the breaks on and slow down steadily for a stop sign that you can’t see. That’s essentially what the RBA is trying to do with interest rates at the moment.

If they push too hard, the RBA risks pushing unemployment up too quickly and sending the economy into recession, resulting in a fall in company profits.

But many economists still disagree on the likelihood of a recession in both Australia and the US, and if there is a recession, how deep and painful it might be (if it’s only a technical recession, we may not even notice).

Geopolitical Influences

Ukraine continues to battle with Russia and while the significance of this conflict is hugely important to its people, it may be less so to the rest of the world’s economy.

This conflict however, could influence how China handles its conflict with Taiwan and that could have far greater global implications.

So does this mean it’s all doom and gloom?

It’s hard to know for certain because the outcomes, timeframes and impacts of the issues mentioned above all remain unknown.

What we do know from history, time and evidence though, is that maintaining a long-term investment approach, while being mindful of your short-term expense needs, provides the best opportunity for long term growth.

The last 10 calendar years of returns for a Balanced Fund (Morningstar Australia Balanced Target allocation) has looked like this:

.png)

While returns have jumped up and down from year to year, the fund above has still provided a 6% pa return over the past decade.